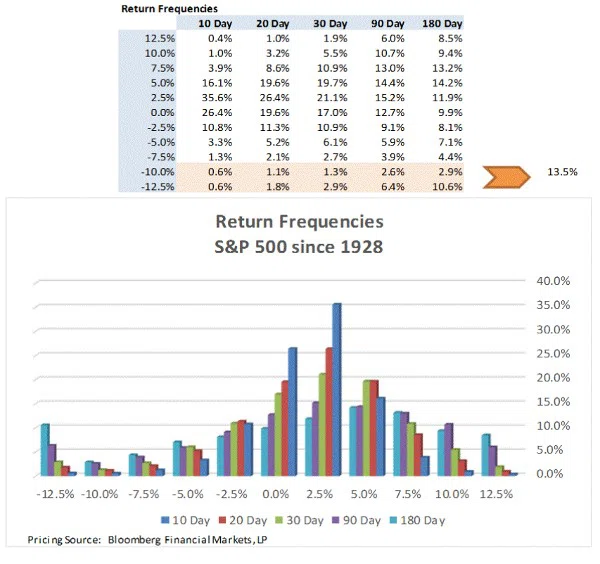

We are writing a quick note on recent market volatility to supplement our longer piece on markets around the world. Over the past 8 years, traders and investors alike have been anesthetized by central banks providing excess liquidity. Prior to this period, market’s regularly showed volatility in the ranges of 10 and 15% pull backs. Off a July 20th high, we are down 6.49% as of yesterday’s close (1990.26) and we had an 11.58% fall relative to the September low of 1884.09 (there was an August low of 1867.61) >read more

Related

2024 Q3 Quarterly Macro Review

2024 Q3 results are in—now we’ll explore where we stand and what’s next after the election.

2025 Q1 Quarterly Macro Review

Q1 signals broad disruption as Trump targets government, trade, and more.

Cognitive Dissonance

Biltmore Family Office is an independent SEC-registered advisor to investment-oriented business owners and their families.