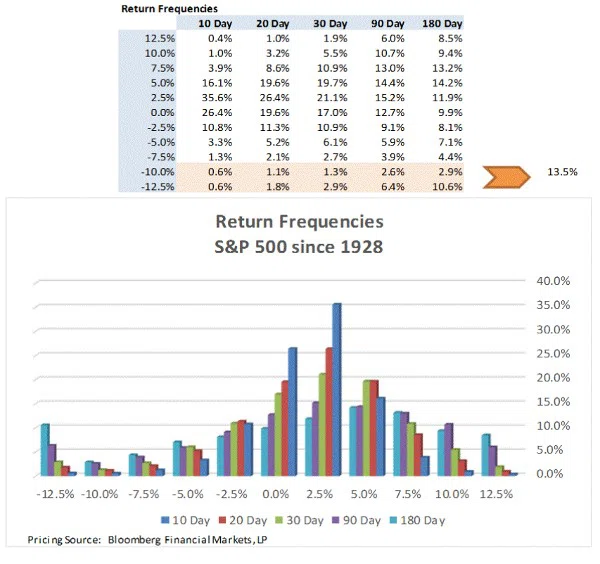

We are writing a quick note on recent market volatility to supplement our longer piece on markets around the world. Over the past 8 years, traders and investors alike have been anesthetized by central banks providing excess liquidity. Prior to this period, market’s regularly showed volatility in the ranges of 10 and 15% pull backs. Off a July 20th high, we are down 6.49% as of yesterday’s close (1990.26) and we had an 11.58% fall relative to the September low of 1884.09 (there was an August low of 1867.61) >read more

Related

2022 Year Ahead - Time of Reckoning

For the investment world, 2021 was an absolute capital markets party. In the face of the pandemic, money rained from th…

2025 Q3 Quarterly Macro Review

Q3's market commentary answers big questions on AI and the technologies usefulness in how we live and market responses.

2022 Q1 Quarterly Macroeconomic Review

Welcome to the Biltmore Family Office Quarterly Macroeconomic overview for Q1 2022. In the linked presentation, we will provide a broad overview of the current investment landscape. Each quarter, we dig deeper into a particular topic, worthy of your attention.