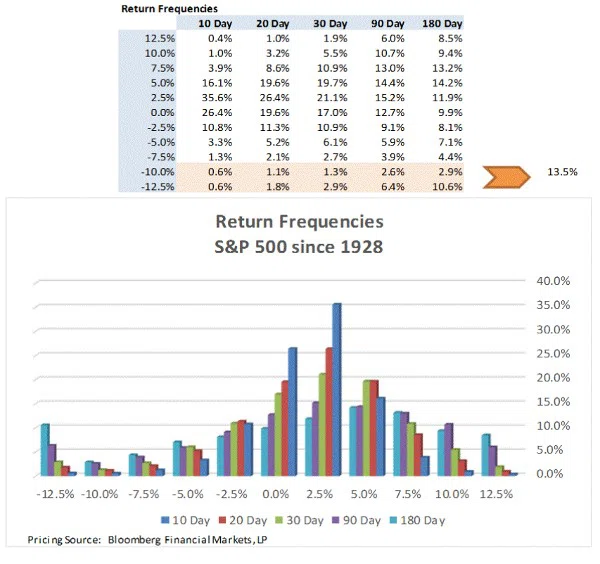

We are writing a quick note on recent market volatility to supplement our longer piece on markets around the world. Over the past 8 years, traders and investors alike have been anesthetized by central banks providing excess liquidity. Prior to this period, market’s regularly showed volatility in the ranges of 10 and 15% pull backs. Off a July 20th high, we are down 6.49% as of yesterday’s close (1990.26) and we had an 11.58% fall relative to the September low of 1884.09 (there was an August low of 1867.61) >read more

Related

A Framework for Recovery

Biltmore Family Office is an independent wealth advisory firm founded by our family and designed for your family working to ensure future generations are prepared to grow and manage the family’s wealth with responsibility, accountability, and respect for legacy.

On Volatility and Opportunity

Biltmore Family Office is an independent SEC-registered advisor to investment-oriented business owners and their families.

2022 Year in Review and 2023 Year Ahead

Review of markets in 2022 and a look ahead to the 2023 year with BFO's Chief Investment Officer, Rael Gorelick.